Repo rate cut fuels hope for homebuyers | Bhubaneswar News

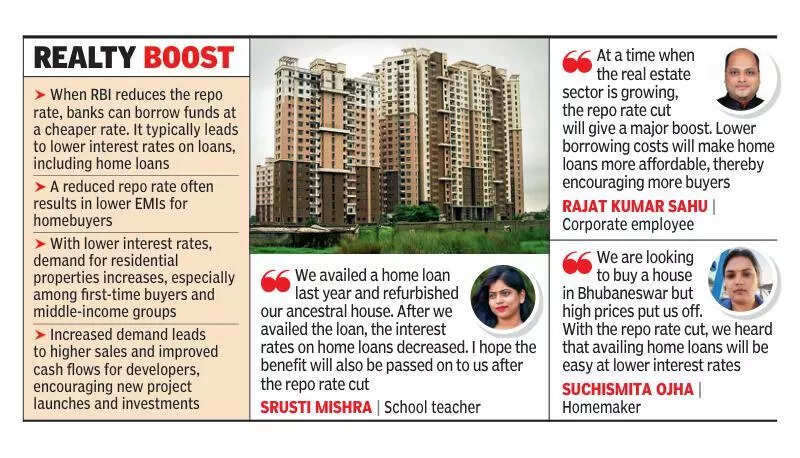

Bhubaneswar: The announcement by Reserve Bank of India (RBI) on Friday to cut the repo rate by 50 basis points to 5.5% is likely to have far-reaching implications, particularly in tier-II cities like Bhubaneswar, where middle-income homebuyers stand to benefit from more accessible home loans, experts said.Amit Mamgain, director of a real estate firm, said that home loans with interest rates below 7.75% will make housing more affordable, especially in the mid-income and affordable housing segments. Industry experts are optimistic about the impact of the rate cut on the real estate sector. “The reduction could trigger increased demand in both residential and commercial sectors,” Mamgain said.The move is particularly significant for prospective homebuyers who were waiting for the right opportunity. Priya Sharma, a resident of Niladri Vihar, expressed relief at the announcement, hoping to finally have a house of her dreams. “In a city like Bhubaneswar, where luxury apartments start at Rs 1.5 crore, the rate cut brings us closer to our dream of home ownership. With our life savings and financial assistance from the banks, we can now hope to have a house of our own,” she said.Industry analyst Shrinivas Rao believes the rate cut comes at an opportune time amid a global growth slowdown. “Major commercial banks are expected to transfer the benefit to homebuyers and developers, which should stimulate real estate demand and investments,” Rao said.Experts said the policy change means reduced EMIs on current loans, while new buyers will have access to more financial options. Developers are also likely to benefit from increased liquidity and renewed buyer confidence, which could boost sales.The real estate industry sees it as a positive step toward economic revival, with the potential to ease credit conditions and accelerate investment cycles. They said the move is particularly timely for first-time buyers and could inject fresh liquidity into project development. Stakeholders are optimistic that the rate cut will help sustain the current upward trend in consumer sentiment and contribute to the overall growth of the real estate sector.