Pay property tax by June 30 & get 10% discount: NMMC | Mumbai News – Times of India

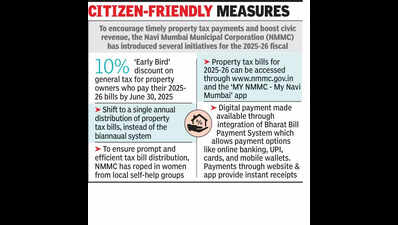

Navi Mumbai: After collecting a record Rs 826 crore in property tax in 2024-25 and setting an ambitious target of Rs 1,200 crore for the 2025-26 fiscal, Navi Mumbai Municipal Corporation (NMMC) announced a 10% ‘Early Bird’ discount on general tax for property owners who pay their 2025-26 bills by June 30. NMMC commissioner Kailas Shinde said the 2025-26 property tax bills are now accessible online. Among the other initiatives to encourage timely tax payments and boost civic revenue is the implementation of a single annual bill distribution system from 2025-26, replacing the earlier practice of distributing bills twice a year. NMMC has also upgraded the online payment system and roped in women from self-help groups to handle the physical bill distribution.“Property tax bills for 2025-26 can now be accessed through www.nmmc.gov.in and the ‘MY NMMC – My Navi Mumbai’ app. A 10% discount on general tax awaits those who settle their bills by June 30, 2025,” said Shinde. “Previously, the corporation distributed bills twice annually to over 3.5 lakh property owners. Limited staff caused delays in distribution and tax collection. Hence, I have instructed swift distribution with additional personnel, implementing a single annual distribution system. The property tax department has recruited women from self-help groups to ensure prompt bill distribution and inform residents about tax concession schemes. Residents are advised to share their mobile phone numbers and email addresses with these representatives for property linking and SMS alerts. Citizens can also complete this procedure independently via www.nmmc.gov.in. The Bharat Bill Payment System supports various payment options, including online banking, UPI, cards, and mobile wallets. Payments through the municipal website and app provide instant receipts, an NMMC official confirmed. NMMC now offers straightforward property tax payments both manually and online with annual billing.Speaking about the reforms in property tax collection and encouraging public cooperation, Shinde said: “This year, many important decisions were taken to make property tax collection more dynamic and citizen-friendly. The new system of ‘One Year, One Bill’, linking KYC to tax bills, online availability of property tax bills, effective use of digital methods of tax payment, and participation of women from self-help groups in bill distribution will not only make the tax collection system easier for citizens, but also provide planning and speed to tax collection.“