Indian Stock Market Surges Since Last Budget | Mumbai News – Times of India

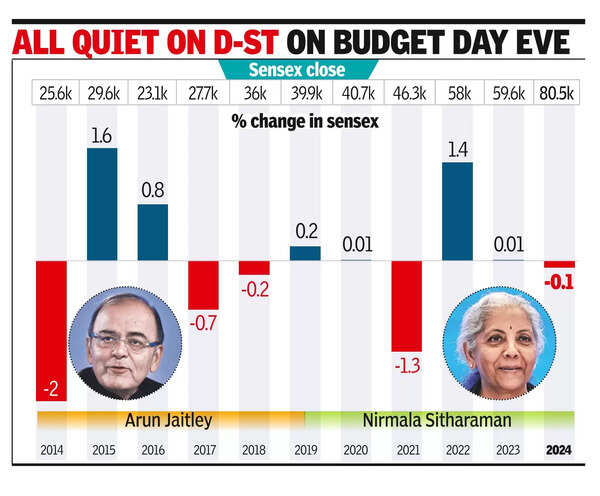

Mumbai: Since finance minister Nirmala Sitharaman’s fifth Budget on Feb 1, 2023, Indian investors have become richer by a staggering Rs 174 lakh crore — translating to about $2.1 trillion at the current rupee-dollar rate. In the same time, the sensex has risen 31% (nearly 21k points) while Nifty has outperformed its more popular peer with a return of 39%, stock exchange data showed.

Gains in the sensex and Nifty, however, fade when compared to the returns in mid and small-caps.While BSE’s Midcap index rose 92% — nearly doubling investors’ money — the Smallcap index was slightly behind at a 90% gain. The rise in these indices during the last 18-plus months came on the back of strong buying by both foreign and domestic investors. Mutual funds had net invested Rs 3.4 lakh crore in the equity market, while FPIs net bought stocks worth Rs 2.1 lakh crore, official data showed.

The turnaround in the fortunes of the Indian market since Feb 2023 is remarkable if we look at how the global economy and markets have traded during the same period. Despite fears of rising inflation in the US and the EU, govt and RBI worked in tandem to keep the impacts of a global inflationary pressure from affecting the Indian economy in any major way. While RBI managed liquidity well and its monetary policies contained inflation, govt kept its market borrowings under check. As a result, the Indian economy didn’t face a runaway inflation and interest rates also didn’t rise much.

Among the highlights of the Indian market was the crash in Adani group shares just around last Budget. After US-based short-seller Hindenburg Research published a damning report on the group on Jan 24, 2023, in about five weeks, the group’s total market value crashed by nearly 65% — from Rs 19.2 lakh crore to about Rs 6.5 lakh crore. Since then, the group has recouped most losses and Sebi didn’t find any proof backing Hindenburg’s allegations of corporate malfeasance by the Indian conglomerate.

The market also discounted the Lok Sabha poll results that saw the BJP’s total seats fall from their number five years ago. Even as markets took a tumble as a knee-jerk reaction, they soon recovered to take the sensex over the 80K-mark — which is seen as a major psychological milestone for Dalal Street.

We also published the following articles recently

Discover the latest update on foreign portfolio investors injecting Rs 15,420 crore in the Indian equity market this week. Total investments for July have surged to Rs 30,772 crore. Market experts suggest the inflows are driven by strong earnings and a decrease in dollar and bond yields.

Stay updated on Indian equity markets as BSE Sensex and Nifty50 open in green. Global markets show mixed trends. Wall Street closes higher. Oil prices edge lower. Foreign investors net buyers. Watch out for Q1 results from companies like Bajaj Auto and L&T Finance.

Discover how stock traders in Asia are gearing up for a potential second term for former US president Trump. Learn about the potential winners and losers in the region and how India and Southeast Asian economies could be impacted differently.