Income tax relief up to 12L cheers middle class | Bhubaneswar News

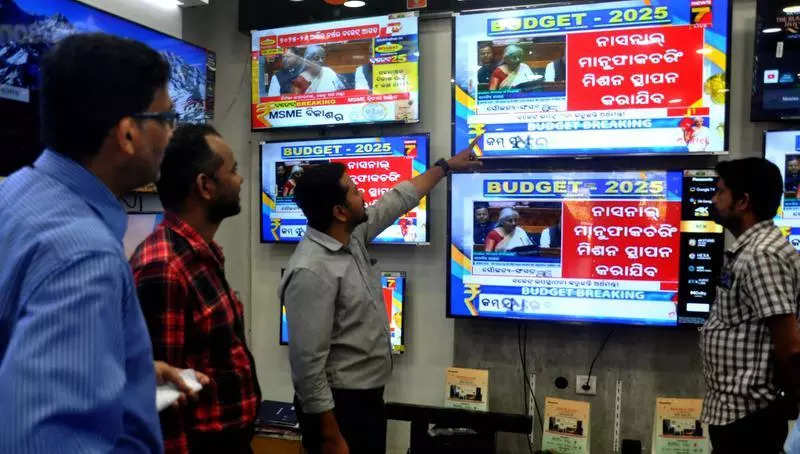

Bhubaneswar: Union finance minister Nirmala Sitharaman‘s announcement of income tax relief up to Rs 12 lakh has brought cheers for the middle class. While the internet is flooded with memes, various sections of people are happy over the tax relief in the Budget.

“No tax up to Rs 12 lakh was unexpected. This will surely provide much-needed relief for middle class professionals like us.The increase in the tax-free income limit will allow us to save more and invest in the future,” said Nirlipta Swain, an IT professional.

Heaving a sigh of relief, Rajesh Mohapatra, a govt employee, said, “For years, the middle class has been asking for tax relief, and the Budget finally delivered. There was a demand for relaxation up to Rs 10 lakh, but when the FM announced Rs 12 lakh, I just jumped from my chair. The higher exemption limit will help us manage rising living costs.”

Many young professionals said the tax relief will ease their financial burden, especially those who are paying EMIs. “After paying taxes and EMIs, we are left with very little for savings. We have to do lots of calculations for any extra expense like planning holidays,” said Amit Mishra, an executive in a private company.

Though the Budget does not have any specific announcement in terms of giving relief to homemakers, women are also happy with the tax relief. However, some expressed disappointment as no announcement was made to check the rising gold prices.

“If we could save on income tax, then the amount will ultimately go to the family savings. Rising prices of essential commodities has made life difficult for middle-class households. Govt should have announced something to check the rising prices of gold, which has gone beyond the reach of middle-class families,” said Silpa Subhadarshini.

Meera Sahu, a schoolteacher, said, “The tax relief means more disposable income for educators like us. It will allow us to invest in the skill development of our children and their education.”

The announcement of simplified TDS (tax deducted at source) rates and the increase in the tax deduction limit for senior citizens to Rs 1 lakh from Rs 50,000 has also been welcomed.

“Raising the TDS exemption to Rs 1 lakh is a great move. It ensures that retirees like us don’t lose a chunk of our savings in tax deductions. It will help us manage our retirement savings better,” said Nirmal Sahu, a retired banker.

“No tax up to Rs 12 lakh was unexpected. This will surely provide much-needed relief for middle class professionals like us.The increase in the tax-free income limit will allow us to save more and invest in the future,” said Nirlipta Swain, an IT professional.

Heaving a sigh of relief, Rajesh Mohapatra, a govt employee, said, “For years, the middle class has been asking for tax relief, and the Budget finally delivered. There was a demand for relaxation up to Rs 10 lakh, but when the FM announced Rs 12 lakh, I just jumped from my chair. The higher exemption limit will help us manage rising living costs.”

Many young professionals said the tax relief will ease their financial burden, especially those who are paying EMIs. “After paying taxes and EMIs, we are left with very little for savings. We have to do lots of calculations for any extra expense like planning holidays,” said Amit Mishra, an executive in a private company.

Though the Budget does not have any specific announcement in terms of giving relief to homemakers, women are also happy with the tax relief. However, some expressed disappointment as no announcement was made to check the rising gold prices.

“If we could save on income tax, then the amount will ultimately go to the family savings. Rising prices of essential commodities has made life difficult for middle-class households. Govt should have announced something to check the rising prices of gold, which has gone beyond the reach of middle-class families,” said Silpa Subhadarshini.

Meera Sahu, a schoolteacher, said, “The tax relief means more disposable income for educators like us. It will allow us to invest in the skill development of our children and their education.”

The announcement of simplified TDS (tax deducted at source) rates and the increase in the tax deduction limit for senior citizens to Rs 1 lakh from Rs 50,000 has also been welcomed.

“Raising the TDS exemption to Rs 1 lakh is a great move. It ensures that retirees like us don’t lose a chunk of our savings in tax deductions. It will help us manage our retirement savings better,” said Nirmal Sahu, a retired banker.