Cybercriminals: 15 cybercriminals arrested for duping PSU officer of ₹3cr | Bhubaneswar News

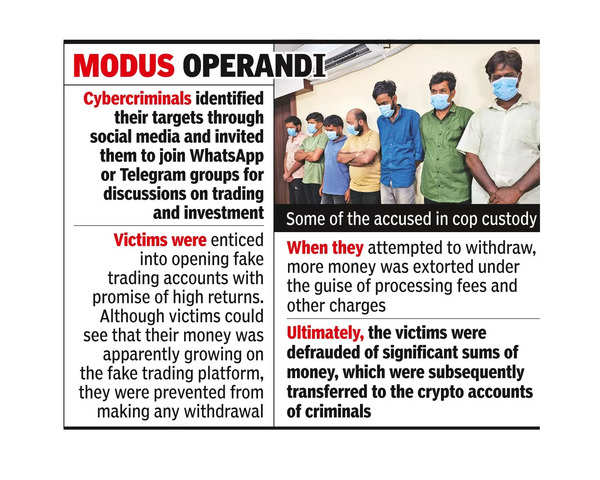

Bhubaneswar: The crime branch on Wednesday arrested 15 men belonging to a cybercrime gang on charges of duping an officer of a central PSU here of Rs 3 crore on the pretext of providing him hefty returns on share trading.

Of the 15, two men are from Delhi and the rest from different parts of the state. As per the crime branch, Tushar Sharma and Bhavesh Thakur from Delhi were the masterminds behind the scam.

They sent a message to the victim through a social media platform on March 29, inviting him to join a WhatsApp group of expert traders to learn the tricks of overnight profits.

“The victim opened a trading account as suggested by the accused. He initially transferred Rs 5 lakh from his wife’s account. He transferred a total of Rs 3.04 crore from five of his accounts to various accounts specified by cyber criminals till June 11,” ADG (crime branch) Arun Bothra said.

Despite several attempts, the complainant failed to withdraw any funds. When he requested withdrawal of his money, he was asked to pay a 20% management fee on his profits. The scammers told him that his profits exceeded 300% and demanded more money towards management fees.

“His requests went unanswered. The scammers subsequently became unreachable, following which he realised that he had fallen victim to a meticulously planned conspiracy and online fraud,” Bothra added.

The crime branch formed five independent teams and began the investigation. During scrutiny of the banking transactions, the teams came across the complicity of 13 men from Odisha.

Their role was to open bank accounts to receive money from several victims and get commissions. They were fully aware that these accounts were being used for cyber fraud.

After verifying in the National Cybercrime Reporting Portal, the crime branch came to know that the bank accounts were used in cyber frauds in many other states.

We also published the following articles recently

RBI raises concerns over misuse of internal accounts in banks for fraud and evergreening of loans. CFOs advised to close unnecessary accounts and tighten control. Internal accounts used for operational efficiency and managing liquidity.

Learn why WhatsApp bans accounts in India and how users can request a review if they believe it was a mistake. Understand the reasons for bans and how to avoid them by following WhatsApp’s Terms of Service.