BMC plans to send monthly text messages on holding tax, trade licence fees | Bhubaneswar News

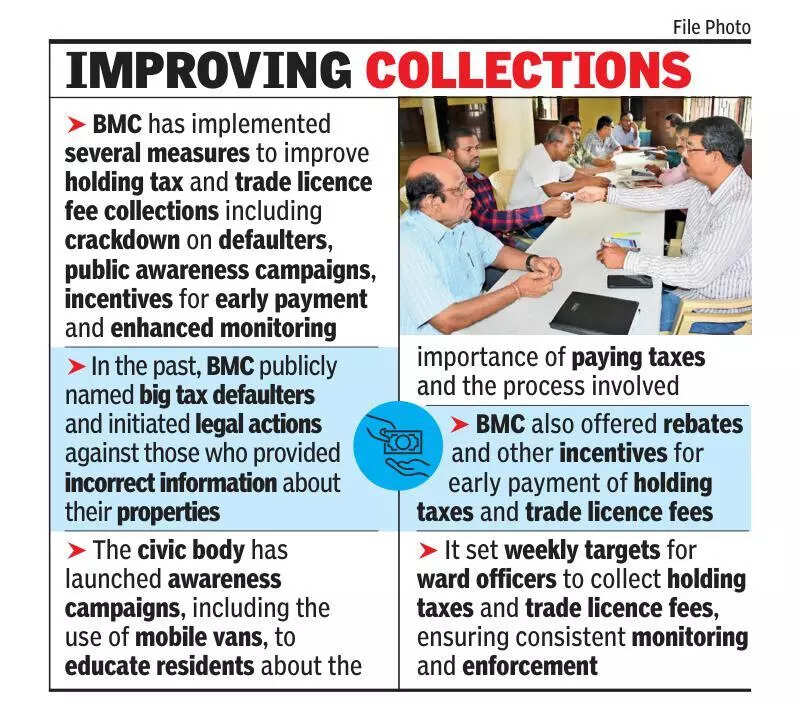

Bhubaneswar: If you have forgotten to pay your holding tax or trade licence fees, don’t worry! The Bhubaneswar Municipal Corporation (BMC) is planning to send reminders through text messages to residents and traders on their mobile phones at the beginning of every month. The objective is to improve the revenue collections of the civic body, officials said.

The plan was discussed during a recent council meeting of the civic body, where the taxation, finance and accounts standing committee of BMC deliberated on the matter and submitted a proposal to the mayor.

Once approved, taxpayers will receive a reminder on their mobile phones, similar to the notifications they receive for energy bill or telephone bill payments.

“Revenue collection from different taxes such as holding tax and trade licence fees was encouraging in the previous financial year. This year too, we are aiming for better collections. For this purpose, innovative approaches are the need of the hour,” chairperson of the committee, Rajkishor Das, said.

Mayor Sulochana Das said that they have taken different steps in the past, such as issuing names of tax defaulters, to remind them of their pending taxes. “The text message as a reminder is another innovative idea that we are considering implementing,” she said.

At the beginning of April, the BMC also issued a public notice informing people to make their holding tax payments via the bhubaneswar.me website, where the civic body offered a straight 5% discount on online payments.

The civic body has also set up as many as 22 revenue collection camps across all three zones of the city to guide and encourage people to make tax payments and improve its revenue collections from the beginning of the financial year.

A total of 13 such camps are currently operating in the city’s south-east zone, 5 in the south-west, and another 4 in the north zone. The revenue collection camps are functioning from different kalyan mandaps and community centres operated by the civic body.

BMC targeted holding tax collections of Rs 100 crore during 2023-24, while the final figure was Rs 94 crore that financial year. During 2024-25, it targeted holding tax collections of Rs 110 crore, while the amount collected was Rs 101 crore. For 2025-26, it has targeted holding tax collections of Rs 120 crore.

The plan was discussed during a recent council meeting of the civic body, where the taxation, finance and accounts standing committee of BMC deliberated on the matter and submitted a proposal to the mayor.

Once approved, taxpayers will receive a reminder on their mobile phones, similar to the notifications they receive for energy bill or telephone bill payments.

“Revenue collection from different taxes such as holding tax and trade licence fees was encouraging in the previous financial year. This year too, we are aiming for better collections. For this purpose, innovative approaches are the need of the hour,” chairperson of the committee, Rajkishor Das, said.

Mayor Sulochana Das said that they have taken different steps in the past, such as issuing names of tax defaulters, to remind them of their pending taxes. “The text message as a reminder is another innovative idea that we are considering implementing,” she said.

At the beginning of April, the BMC also issued a public notice informing people to make their holding tax payments via the bhubaneswar.me website, where the civic body offered a straight 5% discount on online payments.

The civic body has also set up as many as 22 revenue collection camps across all three zones of the city to guide and encourage people to make tax payments and improve its revenue collections from the beginning of the financial year.

A total of 13 such camps are currently operating in the city’s south-east zone, 5 in the south-west, and another 4 in the north zone. The revenue collection camps are functioning from different kalyan mandaps and community centres operated by the civic body.

BMC targeted holding tax collections of Rs 100 crore during 2023-24, while the final figure was Rs 94 crore that financial year. During 2024-25, it targeted holding tax collections of Rs 110 crore, while the amount collected was Rs 101 crore. For 2025-26, it has targeted holding tax collections of Rs 120 crore.