As EV cover picks pace, battery coverage is the name of the game – The Times of India

Chennai: According to auto industry sources and EV dealers, a basic insurance coverage for electric vehicles do not typically include most types of battery failures. Given that battery cost comprises anywhere around 40% of the total vehicle cost, this is a crucial coverage aspect.

A top two-wheeler and four-wheeler dealer in Delhi-NCR said, “It is important that batteries get additional coverage and unless the customers read the fine print many types of battery damages get left out.”

EV dealers say additional battery coverage can mean the final premium is upto 40% steeper for electric passenger vehicles than petrol or diesel ones. In two wheelers, too, battery coverage is often an add-on and in swappable battery vehicles theft is not covered without additional premium. That’s why increasingly customers are asking for specific add-on coverages while opting for insurance.

According to TATA AIG General Insurance Company chief underwriting and data science officer Neel Chheda, EV owners prefer comprehensive protection, which covers their vehicle in total, generally due to the cost of EVs, specialised parts and susceptibility to damages primarily due to electrical fire and battery damage, leading to high repair cost. There are differences in the vehicle components and their manufacturing costs for example heavier battery cost and use of more plastics, specialised repair procedures etc which impacts the average size of an insurance claim following an accident and thereby impacting the premium.

“This makes insurance policies for EVs relatively costlier than insuring an ICE vehicle. Moreover, key components like traction battery costs about 50% of the overall vehicle, therefore replacement cost would be significantly higher,” he said.

So, what are the top reasons for insurance claims in electric cars and two wheelers? Mayur Kacholiya, head – motor product & actuarial, Go Digit General Insurance said, “Given EVs tend to have higher acceleration or torque as the vehicle is turned on, minor damage to parts is common as the owners typically take some time to get accustomed to the higher torque. Additionally, electric vehicles are also prone to claims related to electrical failures, tyre or panel damages and battery-related losses.”

OEMs say comprehensive coverage is picking up even for e-commercial vehicles. Mahesh Babu, CEO, Switch Mobility said, “We’re seeing an encouraging uptake of comprehensive EV insurance across the board.” Typically, these policies include fire protection as a standard feature. While there isn’t a separate battery-specific insurance amount for buses, in the case of our eLCVs, insurers offer special battery coverage that is similar to engine protection in traditional ICE vehicles, he explained. “However, we’ve observed that customers prefer not to opt for this additional battery coverage,” he added. Switch provides a five-year battery warranty for the IeV series extendable by two more years.

That’s true for other segments, too. Top EV OEMs offer five years to eight years warranty for their batteries as a reassurance measure. Said Sunil Kumar, CEO, Greaves Finance, “We’re coming up with a bundled product that includes road side assistance and extended warranty and we also offer loan protection insurance though in April second week we will debut our new vehicle products as well.”

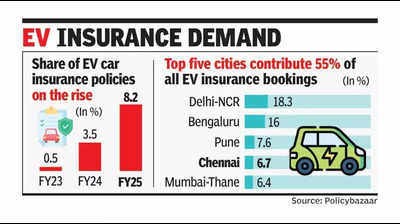

Subhasish Mazumder, head – motor distribution, Bajaj Allianz General Insurance said, the growth of insurance policies for EVs is directly linked to the increasing adoption of these vehicles.